For many med spas, Q1 is the quietest quarter of the year. The holiday rush is over, patients are recovering from December spending, and the excitement of New Year’s resolutions has yet to translate into booked appointments. It’s easy to view these slower months as something to simply survive.

But Q1 also offers something valuable: breathing room to step back, analyze last year’s performance, and build a financial foundation for sustainable growth.

As I shared on the Patient Magnet podcast, to win as a business owner, you need to get an A+ in three classes: marketing, sales, and product delivery—which includes managing your business and fulfilling on your promises. Q1 is your opportunity to ensure that third piece is solid before the busy season demands all your attention.

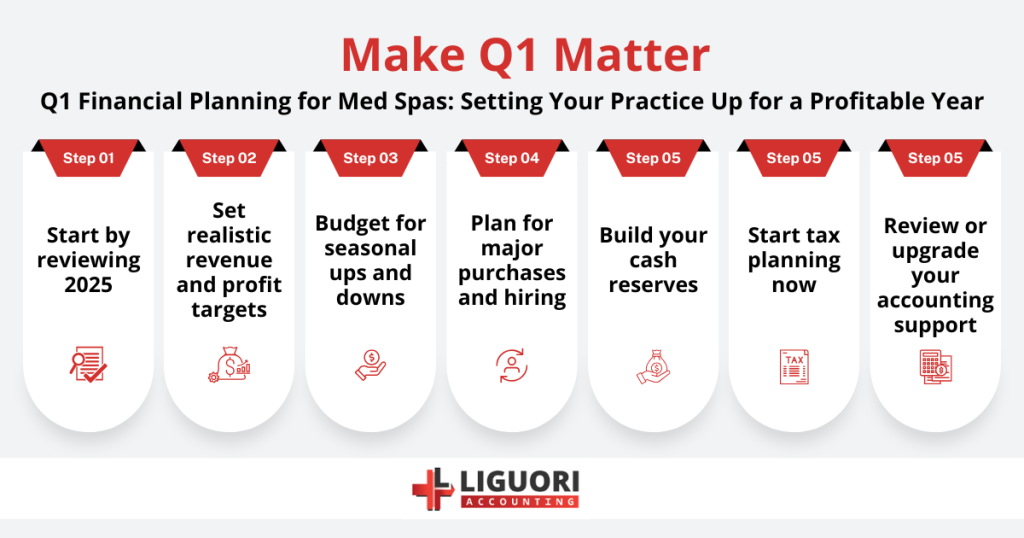

Start With a 2025 Post-Mortem

Before planning 2026, you need to understand what actually happened in 2025. Not what you think happened—what the numbers say.

Pull your profit and loss statement for the full year, broken down by month. This is the most valuable report you can review. Look for patterns: Which months outperformed? Which underperformed? Did your profitable months correspond to specific marketing pushes, new service launches, or seasonal trends you can replicate?

Compare your actual results to whatever projections or budgets you had (if any). If you didn’t have formal projections, this is the year to start. You can’t improve what you don’t measure, and you can’t measure without a baseline.

Pay particular attention to your expense ratios. As we’ve discussed in our guide to financial health for med spa owners, healthy benchmarks include payroll at 25-35% of revenue (including owner compensation), cost of goods around 30%, and gross profit margins of 70% or better.

If you’re outside these ranges, your first planning priority is understanding why—and building a plan to correct it.

Setting Realistic Revenue and Profit Targets

Ambition is good. Delusion is expensive.

I’ve seen too many practice owners set revenue goals based on what they want to earn rather than what their business can reasonably produce. A 50% revenue increase sounds exciting until you realize it requires marketing channels you haven’t built, providers you haven’t hired, or patient volume your schedule can’t accommodate.

Start with your 2025 baseline. What’s a realistic growth rate given your current capacity, team, and market position? For most established med spas, 10-20% year-over-year growth is healthy and achievable. Faster growth is possible but typically requires significant investment in marketing, staff, or equipment.

More importantly, set profit targets—not just revenue targets. As we explored in our essential KPIs guide, a busy practice isn’t necessarily a profitable one. Your goal should be growth that improves your bottom line, not growth that just creates more work.

Budgeting for Seasonal Fluctuations

Every med spa has seasonal patterns. For most practices, Q1 is slower, Q2 picks up as summer approaches, Q3 peaks, and Q4 fluctuates around the holidays. Your cash flow plan needs to account for this reality.

The mistake I see most often: owners spend their Q3 profits as if that’s their normal monthly revenue, then scramble to cover payroll when January arrives with 30% fewer appointments.

Build a monthly budget that reflects your actual seasonal patterns. If January historically produces 75% of your average monthly revenue, budget for that—not for your annual average divided by twelve. This prevents both the cash crunch of slow months and the false confidence of peak months.

Consider holding a portion of your Q3 and Q4 profits in reserve specifically to smooth out Q1 operations. Having two to three months of operating expenses accessible gives you the flexibility to weather slow periods without making reactive decisions.

Planning for Major Purchases and Hiring

Q1 is the time to think strategically about capital investments—not react impulsively to vendor pressure.

If you’re considering new equipment, do your homework now. As I mentioned on the Medical Spa Insider podcast, don’t buy a laser just to save on taxes. If it’s a purchase that will improve your business and you have the patient demand to support it, great—and timing matters for tax benefits. But equipment alone doesn’t generate revenue. Patients do.

Survey your existing patient base before making large purchases. What services are they asking for? What would they actually book? One owner I heard about sent a mass text asking which device type patients would be most interested in, bought based on actual demand, offered early adopters a discount, and had the equipment paid off within months. That’s strategic purchasing.

For hiring, the benchmark we recommend is looking to add providers when you’re consistently at 75-80% utilization. Hiring too early means you’re paying for capacity you don’t need; waiting too long means burnout and patient experience issues. Q1 is a good time to assess where you stand and begin recruiting if needed, so new team members are trained before the busy season.

Cash Reserve Recommendations

How much cash should your med spa keep in reserve? The answer depends on your risk tolerance, fixed costs, and seasonal variability—but here’s a general framework.

At minimum, maintain enough to cover three months of fixed operating expenses: rent, payroll, insurance, loan payments, and essential subscriptions. This gives you runway to navigate unexpected downturns without making desperate decisions.

A healthier target is four to six months, particularly if you’re planning growth investments or your revenue has significant seasonal swings. This buffer lets you make strategic decisions—like hiring ahead of demand or investing in marketing—from a position of strength rather than desperation.

One common cash flow trap: over-purchasing inventory to capture volume discounts. That product sitting on your shelf is cash you can’t use for payroll or marketing. Buy based on actual patient demand, not sales rep projections.

Tax Planning Starts Now

While everyone else scrambles to organize receipts for last year’s taxes, smart practice owners are already planning for the current year. As we detailed in our year-end tax planning guide, the decisions that impact your tax liability happen throughout the year—not just in December.

Q1 priorities include reviewing your entity structure (is an S-corp election right for you?), establishing quarterly estimated tax payments if you’re profitable, and ensuring your retirement accounts are set up to maximize deductions. The goal is eliminating surprises: knowing roughly what you’ll owe and having a plan to pay it.

If your current CPA only talks to you at tax time, you’re getting compliance—not strategy. The difference can be tens of thousands of dollars.

When to Upgrade Your Accounting Support

Many med spa owners start by doing their own books—or hiring a general bookkeeper who learns as they go. That approach can work in the early stages, but there’s a point where the cost of inadequate financial management exceeds the cost of professional support.

Signs you’ve outgrown your current setup include consistently delayed or inaccurate financials, tax surprises that catch you off guard, difficulty understanding which services or providers are actually profitable, and spending your own time on bookkeeping instead of patient care or business development.

The learning curve is steep when you’re starting out, and even if you have some financial competency, there’s the question of bandwidth. You’re already wearing a dozen hats. Every hour spent reconciling transactions is an hour not spent on the activities that actually build momentum in your business.

A specialized accounting partner—one who understands medical aesthetics specifically—can provide Virtual CFO services that transform your financials from a source of stress into a strategic tool.

Make Q1 Count

The work you do in Q1—analyzing last year, setting targets, building budgets, planning strategically—creates the foundation for everything that follows. It’s not glamorous work, but it’s the difference between practices that grow intentionally and practices that just react to whatever happens next.

At Liguori Accounting, we work exclusively with medical aesthetic practices. We understand your seasonal patterns, your service mix considerations, and the specific KPIs that indicate practice health. Our comprehensive approach brings bookkeeping, tax planning, and CFO support under one roof—so you can focus on patient care while we focus on your financial health.

Ready to make 2026 your most profitable year yet? Start a conversation with our team.